A Beginners Guide to CAM

In a shopping center, typically sophisticated Landlords have leases that are NNN, meaning the CAM is passed down to the Tenant who will pay their own pro rata share of Taxes, CAM, and Insurance.

Definition of CAM – Common Area Maintenance

What is included in CAM?

CAM includes but is not limited to cleaning, sweeping, rubbish removal, common area signage, sidewalk repairs, parking lot repairs, landscaping, snow removal, security, and roof repairs. Insurance may be included in a CAM or as a separate line item. Capital expenses, such as a completely new roof, can be amortized over a period of time in CAM. Common area utilities such as the parking lot lights are also part of CAM.

Importance of Understanding CAM

At the very least, there should be a cap on controllable CAM. Typically, a Landlord will agree to a cap on CAM at 5%, non-cumulative or cumulative. This means that the Landlord can only increase the controllable CAM amount by 5% for the following year. In layman’s terms, the Landlord would not be allowed to charge the tenants for all new landscaping in one single year. The cost of new landscaping would have to be spread out over the lease term, so that the Tenants are not burned in a short period of time with an unexpected expense. However, it is reasonable for a Landlord and Tenant to agree that non controllable CAM shall not be capped, which includes snow removal, insurance, and utilities.

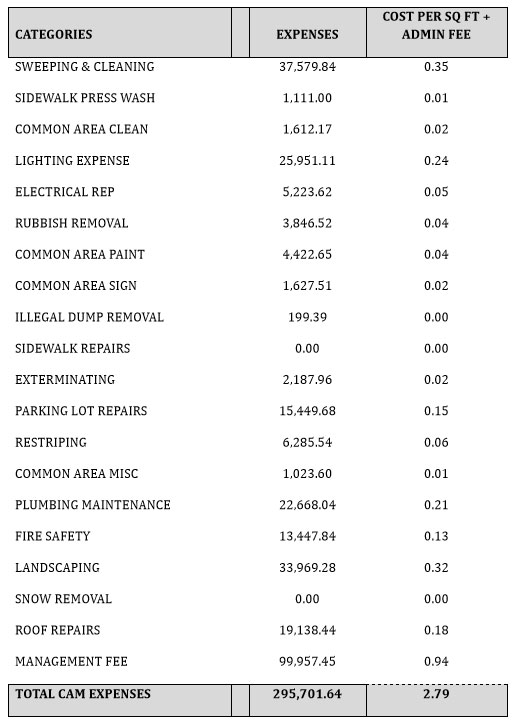

Landlords typically include a Management and Administration Fee in their CAM. Most “mom and pop” tenants overlook this line item which might include a hefty fee. National or sophisticated operators are often able to cap the cost of Management or Admin fees through negotiations during the Letter of Intent stage. An experienced broker will know to ask for a breakdown of CAM and, after reviewing the line items, will know if a Landlord is taking advantage of a tenant by charging very high Management fees. Below is an example of a CAM breakdown. Note that the Management Fee is the majority of the CAM! Depending on the Tenant’s leverage, this fee is negotiable; for example, a national tenant may be able to negotiate this down to as low as 10% of CAM.

There are other lease types, including a modified gross lease, where the Tenant pays a base rent which includes the cost of CAM, and the Tenant only pays the increase in taxes every year. If there is an increase in CAM, the Landlord is burdened with extra expenses, rather than those expenses being passed onto the Tenant.

Many investors are only interested in buying single NNN assets, and that is because those Landlords do not have to be involved at all in the maintenance of the property. The tenant is most likely in a freestanding building, and is responsible for all CAM items, meaning they hire maintenance companies to sweep, remove snow and ice, and maintain the property. The Landlord simply collects their rent check, and that is why these assets tend to have lower cap rates and are worth more to the investor.

In conclusion, it is very important to understand what is fair and typical when entering into a transaction, whether you are the Landlord or the Tenant. The cost of CAM charges is often more than you might expect, and that can eat into your profits if not protected in your lease—which is why the controllable CAM should be capped to a fair degree. Often, sophisticated retailers require the right to audit the Landlord’s CAM budget if they suspect a charge is higher than normal or unexpected. This is why a tenant should not only hire an experienced broker, but a great real estate attorney as well.